WELCOME TO GMS ACCOUNTING ONLINE HELP

The help you need at your fingertips.

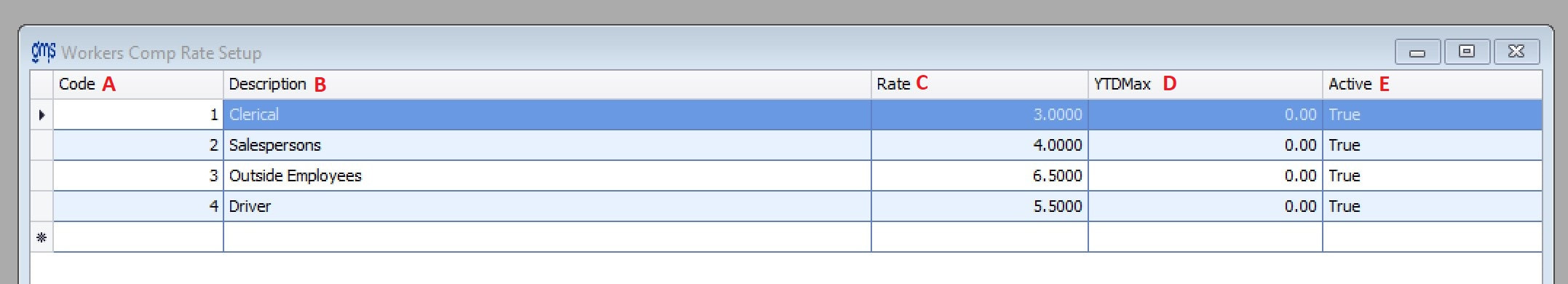

You are here: Payroll > Payroll Setup > Workers Comp Rate

Workers Comp Rate

Define the Worker’s Compensation Insurance rates based on the organization’s current insurance policy. These rates can then be entered in the Employee File and used to generate an entry to accrue Worker’s Comp expenses, based on salary, on a per pay period or monthly basis.

A. Code: Enter a numeric code up to 9-digits.

B. Description: Enter a description for the Worker’s Comp code.

C. Rate: Enter the current rate for the Worker’s Comp classification.

D. YTDMax: Should the Worker’s Comp Insurance policy have a maximum taxable salary amount, please enter the amount in this field. This maximum amount is only used for Supplement #311 Year to Date Workers Comp Analysis.

E. Active: Enter True if this Workers Comp rate may be used. If it is no longer to be used, enter False