WELCOME TO GMS ACCOUNTING ONLINE HELP

The help you need at your fingertips.

You are here: Payroll > Payroll Setup > Workers Comp Base

Workers Comp Base

The base is used in the Worker’s Comp calculation for Supplement #299 Direct Monthly Direct Worker’s Comp, and Supplement #311 YTD Worker’s Comp Analysis.

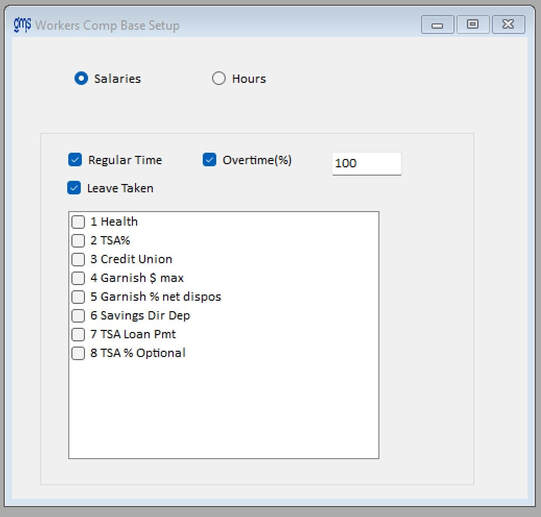

Salaries: Select this option if Salaries are to be used as the base for Worker’s Comp eligible wages.

Salaries: Select this option if Salaries are to be used as the base for Worker’s Comp eligible wages.

Regular Time: Click this option if Regular Time worked is to be included as part of the base.

Overtime(%): Click this option if Overtime is to be included as part of the base. If Overtime is included, please indicate the percentage of Overtime Salaries to be included in the base.

Leave Taken: Click this option if you are required to pay workers comp on salaries paid to employees for leave time.

List Box of Deductions: Select the deductions that should be deferred from Taxable Workers Comp Wages.

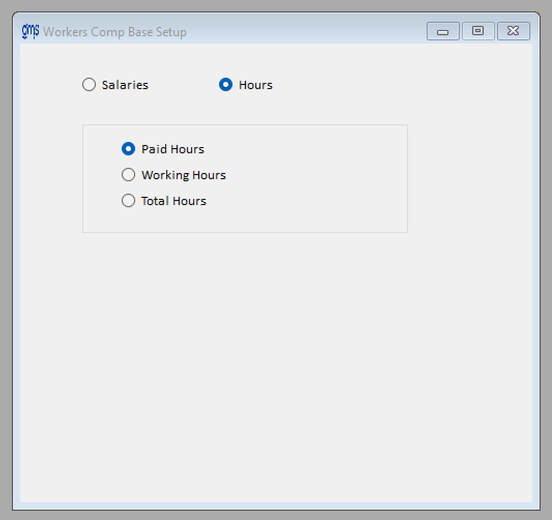

Hours: Select this option if Hours are to be used as the base for Worker’s Comp eligible wages. If hours are selected the following options are available:

Overtime(%): Click this option if Overtime is to be included as part of the base. If Overtime is included, please indicate the percentage of Overtime Salaries to be included in the base.

Leave Taken: Click this option if you are required to pay workers comp on salaries paid to employees for leave time.

List Box of Deductions: Select the deductions that should be deferred from Taxable Workers Comp Wages.

Hours: Select this option if Hours are to be used as the base for Worker’s Comp eligible wages. If hours are selected the following options are available:

Paid Hours: Click this option to include all paid hours in the base. This will include Regular Time, Overtime, and all paid Leave types.

Working Hours: Click this option to include all working hours. This will include Regular Time, Overtime, and Compensatory Time earned, should your agency track Comp time. This option will not include any Leave time.

Total Hours: Click this option to include all paid and working hours.

Working Hours: Click this option to include all working hours. This will include Regular Time, Overtime, and Compensatory Time earned, should your agency track Comp time. This option will not include any Leave time.

Total Hours: Click this option to include all paid and working hours.