WELCOME TO GMS ACCOUNTING ONLINE HELP

The help you need at your fingertips.

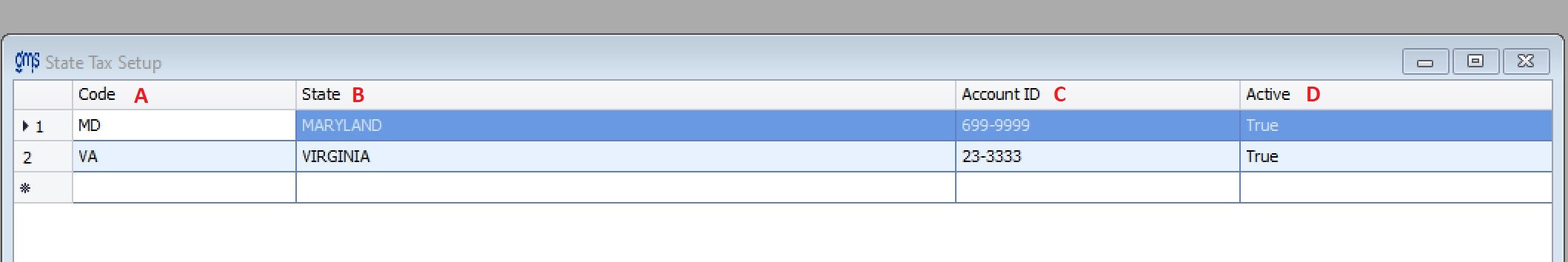

You are here: Payroll > Payroll Setup > State Tax

State Tax

For organizations that withhold different employee’s state taxes from one or more states, this allows entry for all applicable state codes and account numbers. This information can be accessed for various multiple state reporting needs and will also be used for W-2 information.

A. Code: Select the two-letter state abbreviation.

B. State: The state represented by the two-letter abbreviation above will automatically appear in this field.

C. Account ID: Enter the state taxpayer identification number.

D. Active: Enter True if this State Tax Code may be used. If it is no longer to be used, enter False.

B. State: The state represented by the two-letter abbreviation above will automatically appear in this field.

C. Account ID: Enter the state taxpayer identification number.

D. Active: Enter True if this State Tax Code may be used. If it is no longer to be used, enter False.