WELCOME TO GMS ACCOUNTING ONLINE HELP

The help you need at your fingertips.

You are here: Payroll > Payroll Setup > Special Pay

Special Pay

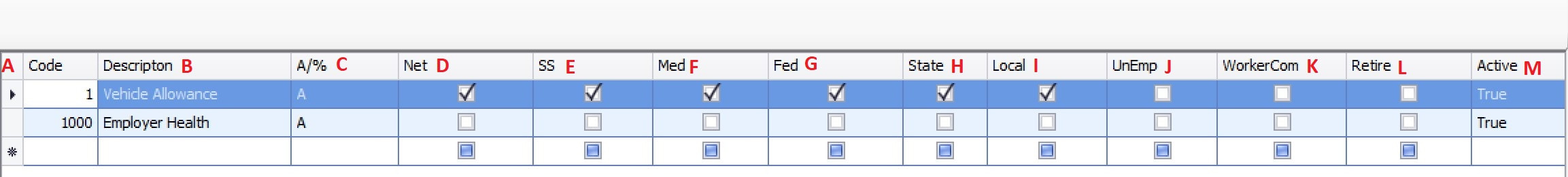

The system allows the setup of special pay requirements that are not driven by a Timesheet. Examples of special pay may include: an ongoing reimbursement to staff for a taxable fringe benefit. The setup will define whether the Special Pay is taxable for Social Security, Medicare, Federal, State and Local tax computations as well as if the Special Pay has any effect on eligible wages for Unemployment, Worker’s Comp or the Retirement Report supplement. In addition, you will also define if the Special Pay gets added to the employee’s net pay if the employee has already received the funds and is now only having the appropriate taxes withheld.

Note: Special Pay Code 1000 is reserved to record the employer's share of health insurance coverage.

Note: Special Pay is typically not used for 3rd party sick pay.

Note: Special Pay Code 1000 is reserved to record the employer's share of health insurance coverage.

Note: Special Pay is typically not used for 3rd party sick pay.

A. Code: Enter a numeric code up to 9-digits.

B. Description: Enter a description for the Special Pay.

C. A/%: Enter an “A” if the Special Pay is going to be a set dollar amount. Enter a “%” if the Special Pay is going to be a percentage of gross wages.

D. Net: Check this box if the amount of the Special Pay will be added to the total pay and net pay. If this box is not checked, the amount identified for the Special Pay will be used in calculating the appropriate taxes, however, the Special Pay amount will not be added to the paycheck.

E. SS: Check this box if the Special Pay is taxable for Social Security computations.

F. Med: Check this box if the Special Pay is taxable for Medicare computations.

G. Fed: Check this box if the Special Pay is taxable for Federal Income Tax computations.

H. State: Check this box if the Special Pay is taxable for State Income Tax computations.

I. Local: Check this box if the Special Pay is taxable for Local Tax computations.

J. Unemp: Check this box if the Special Pay is to be included in Unemployment Insurance eligible wages.

K. WorkerCom: Check this box if the Special Pay is to be included in the Worker’s Comp Insurance calculation.

L. Retire: Check this box if the Special Pay is to be included in Retirement eligible wages on the Retirement Report supplement.

M. Active: Enter True if this Special Pay Code may be used. If it is no longer to be used, enter False.

B. Description: Enter a description for the Special Pay.

C. A/%: Enter an “A” if the Special Pay is going to be a set dollar amount. Enter a “%” if the Special Pay is going to be a percentage of gross wages.

D. Net: Check this box if the amount of the Special Pay will be added to the total pay and net pay. If this box is not checked, the amount identified for the Special Pay will be used in calculating the appropriate taxes, however, the Special Pay amount will not be added to the paycheck.

E. SS: Check this box if the Special Pay is taxable for Social Security computations.

F. Med: Check this box if the Special Pay is taxable for Medicare computations.

G. Fed: Check this box if the Special Pay is taxable for Federal Income Tax computations.

H. State: Check this box if the Special Pay is taxable for State Income Tax computations.

I. Local: Check this box if the Special Pay is taxable for Local Tax computations.

J. Unemp: Check this box if the Special Pay is to be included in Unemployment Insurance eligible wages.

K. WorkerCom: Check this box if the Special Pay is to be included in the Worker’s Comp Insurance calculation.

L. Retire: Check this box if the Special Pay is to be included in Retirement eligible wages on the Retirement Report supplement.

M. Active: Enter True if this Special Pay Code may be used. If it is no longer to be used, enter False.