WELCOME TO GMS ACCOUNTING ONLINE HELP

The help you need at your fingertips.

You are here: List of Changes > September 2020

What to expect – version 2.4.77.158

September 16, 2020

September 16, 2020

AFTER THE 2.4.77.158 REVISION HAS BEEN INSTALLED

Before processing your next payroll in GMS please follow the instructions below:

Before processing your next payroll in GMS please follow the instructions below:

Go to Payroll, Set Up, SS Tax Deferral and check the applicable box that applies to your organization’s decision regarding the SS Tax Deferral change recently enacted by the President.

If your organization wishes to Opt In – you will check the Opt In box and click on Save Setup.

If your organization wishes to Opt In – you will check the Opt In box and click on Save Setup.

- If you want to continue answer yes to “Are you sure you wish to continue?”

- The setup will be saved and then click “OK”

- The Setup SS Tax Deferral Opt In acknowledgement will be displayed. This can be printed or exported for your records.

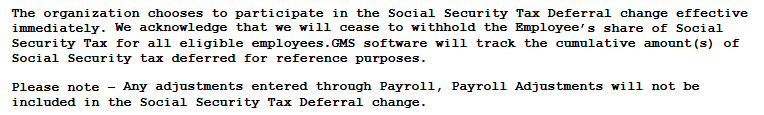

By choosing to Opt-In the following will become effective immediately:

A SS Deferral Tax Register has been added in PR Processing, Prepare Payroll, Payroll/Deduction Register. Print this SS Deferral Tax Register to keep track of deferred SS amounts and to use as a reference and for reconciling.

A YTD SS Tax Deferral Register Button has been added to PR Processing/YTD Payroll Register. This Register will provide you with the ability to print a YTD, QTD and previous payroll’s SS Deferral Tax Register for reconciliation and reference purposes.

A YTD SS Tax Deferral Register Button has been added to PR Processing/YTD Payroll Register. This Register will provide you with the ability to print a YTD, QTD and previous payroll’s SS Deferral Tax Register for reconciliation and reference purposes.

If your organization wishes to Opt Out – you will check the Opt Out box and click on Save Setup.

- If you want to continue answer yes to “Are you sure you wish to continue?”

- The setup will be saved and then click “OK”

- The Setup SS Tax Deferral Opt Out acknowledgement will be displayed. This can be printed or exported for your records.

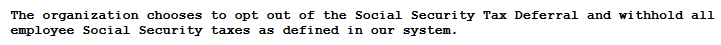

By choosing to Opt Out, the following will apply.

You will see no changes to the Payroll Processing menu steps when the Opt Out option is chosen.