WELCOME TO GMS ACCOUNTING ONLINE HELP

The help you need at your fingertips.

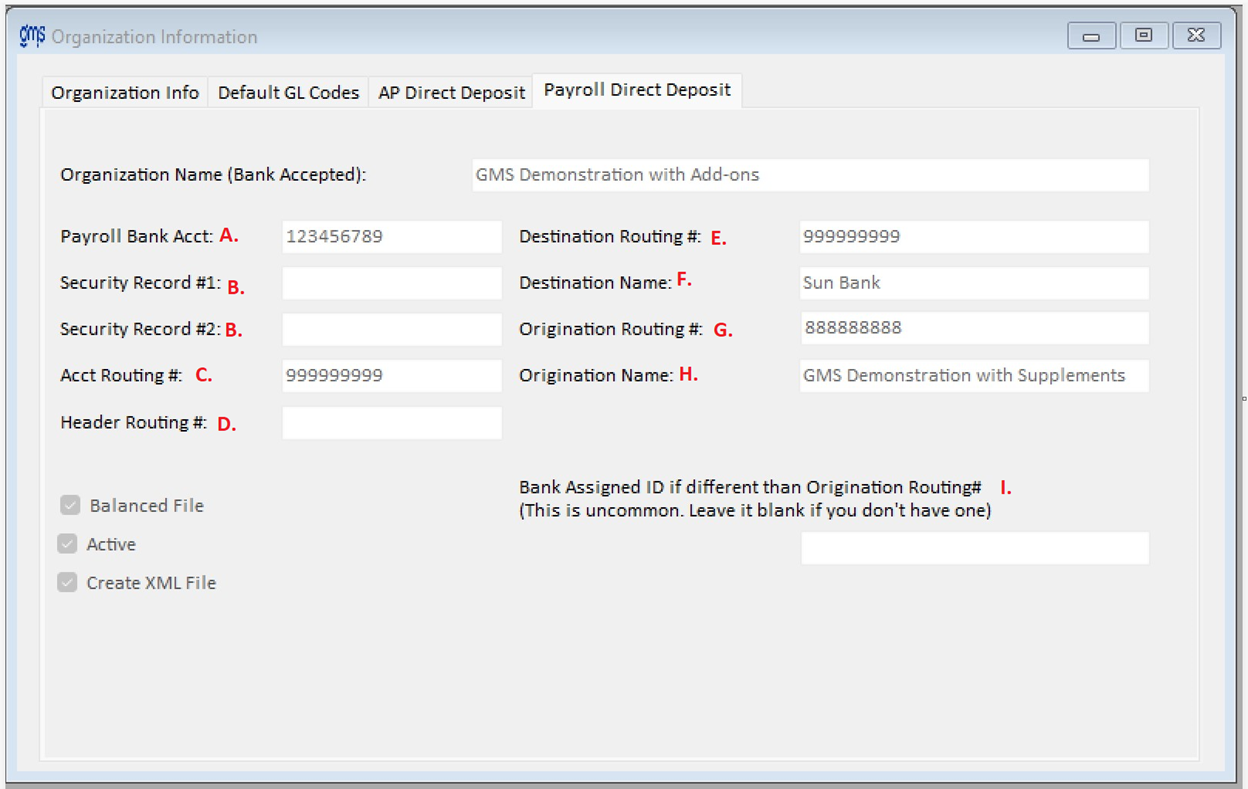

You are here: Tools > Organization > Payroll Direct Deposit

Payroll Direct Deposit

The payroll direct deposit information must be set up if Payroll Direct Deposit will be utilized.

Function

Enables the payroll processing software to prepare data for your bank to automatically deposit net pay and other selected payroll withholdings directly into employees’ bank accounts.

Things You Should Know

Organization Name: Enter the bank accepted agency name.

The payroll direct deposit information must be set up if Payroll Direct Deposit will be utilized.

Function

Enables the payroll processing software to prepare data for your bank to automatically deposit net pay and other selected payroll withholdings directly into employees’ bank accounts.

Things You Should Know

- File data is prepared in accordance with the National Automated Clearing House Association (NACHA) procedures, the standard followed by nearly all banking institutions. These procedures permit your bank to deposit funds into employee’s bank accounts even if they bank with another institution.

Organization Name: Enter the bank accepted agency name.

(A) Payroll Bank Acct: Enter your agency’s bank account number from which funds should be withdrawn. This field is alpha-numeric. No dashes or spaces should be used.

(B) Security Record #1: If the bank requires a lead security record at the beginning of the direct deposit file, it would be entered here. No dashes or spaces should be used.

(B) Security Record #2: If the bank requires a secondary lead security record at the beginning of the direct deposit file, it would be entered here. No dashes or spaces should be used.

(C) Acct Routing #: Enter your bank’s routing number. No dashes or spaces should be used.

(D) Header Routing #: In most cases the header number and the number appearing in records 5 and 8 of the NACHA file transmitted to your bank are the same. If this is the case, then all three fields are populated by the routing number you enter in the Origination Routing # field as defined below.

Following are two examples of possible changes to the standard format required by your bank:

- If your bank requires a different number in the Header Routing # field than appears in records 5 and 8, enter that required number here.

- If your bank requires the same number as in records 5 and 8 only preceded by a space rather than a “1” (the “1” being standard) enter a space followed by the same routing number as entered in the Origination Routing # field above.

(E) Destination Routing #: Enter the routing number of the Destination Depository Financial Institution, typically your local bank. However, it may be the Federal Reserve Bank, depending on who processes the file. No dashes or spaces should be used.

(F) Destination Name: Enter the name of the Destination Depository Financial Institution, typically your local bank. However, it may be the Federal Reserve Bank, depending on who processes the file.

(G) Origination Routing #: If your local bank is the destination name entered above, you would enter your agency’s Federal ID number in this field. In the circumstance that the destination name is a Federal Reserve Bank, you would enter your local bank’s ABA routing number. No dashes or spaces should be used. If your bank requires a “1” between the destination routing number and the organization routing number, enter a 1 in front of your organization number. This is a filler space and is normally left blank.

Note: For banks that require a special designation in this area, the field is alpha/numeric.

(H) Origination Name: If your local bank is the destination name entered above, you would enter your agency’s bank accepted name, the same as was entered in Organization name. In the circumstance that the destination name is a Federal Reserve Bank, you would enter your local bank’s name.

(I) Bank Assigned ID: In most cases, this field will be left blank. If your bank has assigned a different number than the Origination Routing #, enter it here.

Balanced File: If your bank requires a balanced file, check the box.

Active: Uncheck the box if you want to issue payroll checks for employees who are set up with deduction 99 DD Net Pay. This would typically be unchecked for one-time circumstances such as bonus checks. In addition to unchecking the Active box to produce checks for employees who normally receive direct deposit, you should also answer the question “All Deductions?” No and do not withhold any deductions that are normally deducted and transmitted as part of direct deposit.

Create XML File: Clients using TeamKeeper software, check this box so the XML file that is sent to TeamKeeper will be created during the Print Direct Deposit and/or Print Checks step on the PR Processing menu. This file will be located in the C:\GMSACTG.net\gmssys folder.