WELCOME TO GMS ACCOUNTING ONLINE HELP

The help you need at your fingertips.

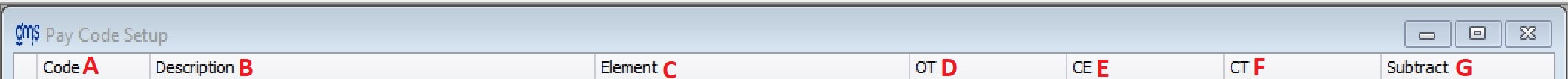

You are here: Payroll > Payroll Setup > Pay Code

Pay Code

The two-letter Pay Code for all leave taken types is set up on this form. The Program Element codes and Descriptions must be set up in GMS Main, General Ledger, Program Elements before you can enter them in this set up file.

Things you should know

Things you should know

- To direct charge leave costs to programs, this form would have zeros in the element fields. In this case, all pay codes must have zeros.

- There are two pay codes set aside for paying unused leave time upon termination. Those reserved codes are AT for annual leave termination pay and ST for sick leave termination pay

- Leave without pay should be setup with LP as the code. When entering timesheets using LP, no dollar amount will be calculated. Military leave should be set up as ML for the pay code and no dollar amount will be calculated.

- Other items set up on this form are the organization’s OT Rate, CE Rate and CT Rate. Please note that the OT, CE and CT rates defined on this form are agencywide and are not linked to any other Pay Code that appears on this form.

A. Pay Code: Enter a two-letter code for the leave type.

Note: Should you need additional codes for leave without pay, such as MT for Maternity Leave, create them on this form. Then refer to the Payroll\Timesheet Entry\Adjust section of the Help Manual for further instructions.

B. Description: Enter a description for the leave type.

C. Element: Enter the program element code for this leave type or click in the combo box arrow to select a program element from the listing. Leave program element codes must be 995100-996900.

D. OT Rate: Enter the rate of pay for overtime, i.e., 1.5. OT Rate establishes the rate of pay at which overtime will be paid, i.e., “time and a half”.

E. CE Rate: Enter the rate at which Comp Time is earned, i.e., 1.0. CE Rate establishes the rate at which employees earn Compensatory (Comp) time. For example, a Comp Time earned rate of 1.0 means an employee would earn 1 hour of available Comp Time for every extra hour worked.

F. CT Rate: Enter the second rate at which Comp time is earned, i.e., 1.5. CT Rate establishes a second rate at which employees earn Compensatory (Comp) Time. For example, a Comp Time earned rate of 1.5 means an employee would earn 1.5 hours of available Comp Time for every extra hour worked.

G. Subtract: If there is a pay code that is not a leave balance type, enter the leave balance type pay code under the Subtract column to have amounts subtracted from the specified leave balance.

Under the Subtract column, enter the pay code that represents the leave balance from which those hours are to be subtracted. For example, for AT – annual leave termination pay – normally AL would be the leave balance it is to be subtracted from. When either of those pay codes are included on a timesheet, no leave earnings will be calculated on the hours.

Note: Should you need additional codes for leave without pay, such as MT for Maternity Leave, create them on this form. Then refer to the Payroll\Timesheet Entry\Adjust section of the Help Manual for further instructions.

B. Description: Enter a description for the leave type.

C. Element: Enter the program element code for this leave type or click in the combo box arrow to select a program element from the listing. Leave program element codes must be 995100-996900.

D. OT Rate: Enter the rate of pay for overtime, i.e., 1.5. OT Rate establishes the rate of pay at which overtime will be paid, i.e., “time and a half”.

E. CE Rate: Enter the rate at which Comp Time is earned, i.e., 1.0. CE Rate establishes the rate at which employees earn Compensatory (Comp) time. For example, a Comp Time earned rate of 1.0 means an employee would earn 1 hour of available Comp Time for every extra hour worked.

F. CT Rate: Enter the second rate at which Comp time is earned, i.e., 1.5. CT Rate establishes a second rate at which employees earn Compensatory (Comp) Time. For example, a Comp Time earned rate of 1.5 means an employee would earn 1.5 hours of available Comp Time for every extra hour worked.

G. Subtract: If there is a pay code that is not a leave balance type, enter the leave balance type pay code under the Subtract column to have amounts subtracted from the specified leave balance.

Under the Subtract column, enter the pay code that represents the leave balance from which those hours are to be subtracted. For example, for AT – annual leave termination pay – normally AL would be the leave balance it is to be subtracted from. When either of those pay codes are included on a timesheet, no leave earnings will be calculated on the hours.