WELCOME TO GMS ACCOUNTING ONLINE HELP

The help you need at your fingertips.

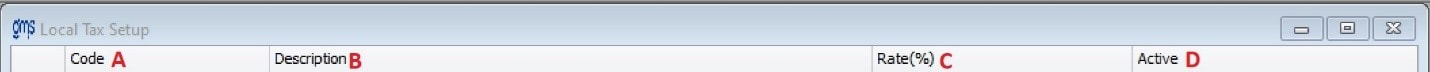

You are here: Payroll > Payroll Setup > Local Tax

Local Tax

For organizations that need to withhold local taxes from their employee’s pay, the local tax jurisdictions and corresponding rates are defined here. In addition to setting up the withholding, there are various reporting options available, including special reports when multiple local Tax codes are defined.

A. Code: Enter a numeric code up to 6-digits.

Note: For PA organizations you can enter 6-digit codes and descriptions as defined by PA Act 32. These codes can be found at http://www.newpa.com/local-government/tax- information/act32#eit_psd_codes

B. Description: Enter a description for the Local Tax jurisdiction.

C. Rate (%): Enter the percentage to be withheld from local taxable wages in decimal form.

D. Active: Enter True if this Local Tax jurisdiction may be used. If it is no longer to be used, enter False.

Maryland County codes and Rates: Use the following chart for the Maryland County Codes. However, under setups a code cannot be listed twice with different descriptions, so the description should include all counties listed. When the local tax code setup is printed, it will limit the number of characters to print for the descriptions. GMS maintains the MD county rates within the software. The local rate is not used but may be entered into the employee file to not cause confusion.

Code County Rate

1 Worchester 2.25

2 Talbot 2.40

3 Anne Arundel 3.20

4 Garrett 2.65

5 Cecil 2.80

6 Charles 3.03

7 Carroll 3.03

8 Wicomico, Queen Anne's, Baltimore City, Somerset 3.20

9 Howard, Montgomery and Prince George 3.20

10 Calvert, St. Mary 3.00

11 Dorchester 3.20

12 Caroline 3.20

13 Baltimore 3.20

14 Allegany 3.03

15 Fredrick 3.20

16 Hartford 3.06

17 Washington 2.95

18 Kent 3.20

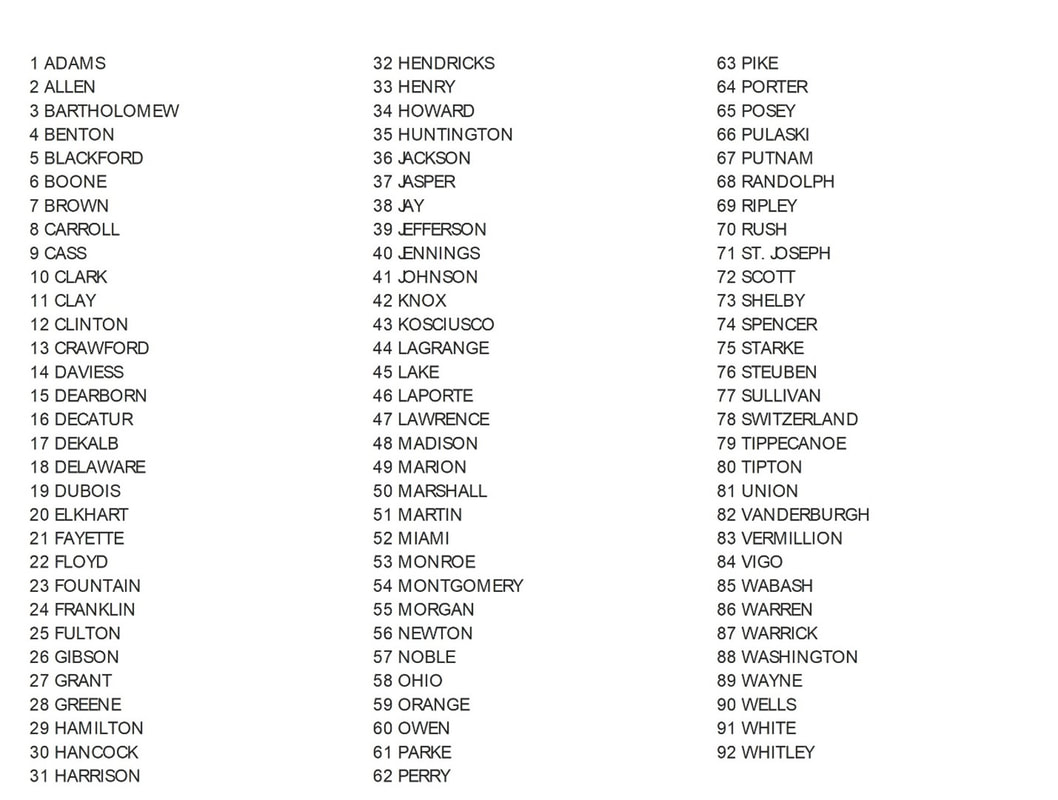

Indiana local tax: The state of Indiana requires that local taxable wages are equal to gross wages less state deferrals and the number of state dependents. When local taxes are to be calculated, if it finds the state code IN that has a local tax code set up for an employee, it will display the question “What state do you pay local taxes in?” If the state of IN is given, it will then do the special calculation to calculate the IN local taxes.

Note: For PA organizations you can enter 6-digit codes and descriptions as defined by PA Act 32. These codes can be found at http://www.newpa.com/local-government/tax- information/act32#eit_psd_codes

B. Description: Enter a description for the Local Tax jurisdiction.

C. Rate (%): Enter the percentage to be withheld from local taxable wages in decimal form.

D. Active: Enter True if this Local Tax jurisdiction may be used. If it is no longer to be used, enter False.

Maryland County codes and Rates: Use the following chart for the Maryland County Codes. However, under setups a code cannot be listed twice with different descriptions, so the description should include all counties listed. When the local tax code setup is printed, it will limit the number of characters to print for the descriptions. GMS maintains the MD county rates within the software. The local rate is not used but may be entered into the employee file to not cause confusion.

Code County Rate

1 Worchester 2.25

2 Talbot 2.40

3 Anne Arundel 3.20

4 Garrett 2.65

5 Cecil 2.80

6 Charles 3.03

7 Carroll 3.03

8 Wicomico, Queen Anne's, Baltimore City, Somerset 3.20

9 Howard, Montgomery and Prince George 3.20

10 Calvert, St. Mary 3.00

11 Dorchester 3.20

12 Caroline 3.20

13 Baltimore 3.20

14 Allegany 3.03

15 Fredrick 3.20

16 Hartford 3.06

17 Washington 2.95

18 Kent 3.20

Indiana local tax: The state of Indiana requires that local taxable wages are equal to gross wages less state deferrals and the number of state dependents. When local taxes are to be calculated, if it finds the state code IN that has a local tax code set up for an employee, it will display the question “What state do you pay local taxes in?” If the state of IN is given, it will then do the special calculation to calculate the IN local taxes.