WELCOME TO GMS ACCOUNTING ONLINE HELP

The help you need at your fingertips.

You are here: Payroll > Payroll Setup > Deduction

Deduction

Deduction

This form is used to set up all deductions to be used during Payroll Processing. Once these deductions are set up, they will be accessible in the Employee File for further definition. Social Security, Medicare, Federal, and State withholding taxes do not need to be set up here as they are established under the Tax/Deduction tab of the Employee File.

To delete a deduction that has not been used in any employee file, click edit and double click on the deduction to be deleted.

This form is used to set up all deductions to be used during Payroll Processing. Once these deductions are set up, they will be accessible in the Employee File for further definition. Social Security, Medicare, Federal, and State withholding taxes do not need to be set up here as they are established under the Tax/Deduction tab of the Employee File.

To delete a deduction that has not been used in any employee file, click edit and double click on the deduction to be deleted.

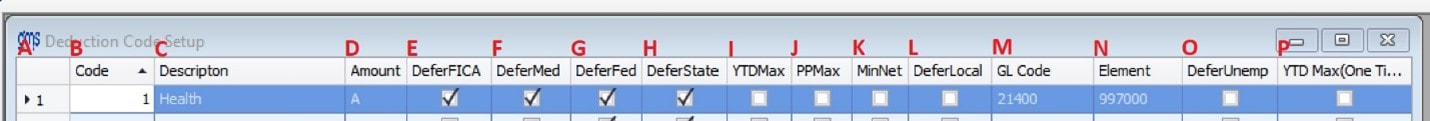

A. Click on the * on the last line to add a new deduction

B. Code: Enter a numeric code up to 9-digits. If Supplement #306, Payroll Direct Deposit has been installed, enter code number 99 with a description that says Net Direct Deposit if the total net pay is to be direct deposited.

Note: Codes 90-95 are reserved for deductions to be based on a % of hours. Code 98 is reserved for Ohio School taxes. Codes 98 and 99 are preset in the table and should not be used for anything else.

C. Description: Enter a description for the deduction.

D. A or %: Enter an “A” if the deduction is a set dollar amount. Enter a “%” if the deduction is a percentage of gross wages.

E. Defer FICA: Click this box if the deduction is deferred from Social Security tax.

F. Defer Med: Click this box if the deduction is deferred from Medicare tax.

G. Defer Fed: Click this box if the deduction is deferred from Federal Income tax.

H. Defer State: Click this box if the deduction is deferred from State Income tax.

I. YTD Max: Click this box if there will be a Year to Date maximum amount for this deduction. If this box is checked, go to the Tax/Deduction tab of the Employee File, and enter the YTD maximum amount for this deduction in the grid. Once the YTD total for the deduction reaches the YTD maximum, the deduction will cease being deducted.

J. PP Max: Click this box if there will be a Per Pay Period maximum amount for this deduction. This option can only be used with a deduction setup as a percentage. If this box is checked, go to the Tax/Deduction tab of the Employee File and enter the Pay Period maximum amount for this deduction in the grid. During payroll processing, as this percentage deduction is calculated based on the gross wages, the result will not exceed the maximum as defined.

K. Min Net: Click this box if there will be a minimum net pay amount assigned to the deduction. If this box is checked, go to the Tax/Deduction tab of the Employee File and enter the Pay Period minimum net amount for this deduction in the grid. During payroll processing, if the deduction will cause the employee’s net pay to drop below this minimum amount, the system will reduce the amount of the deduction, so the net pay equals the amount set up in the grid. If the net pay is already below the defined amount before the deduction is processed, the deduction is suspended for the current payroll. If the minimum net is to be calculated after subtracting mandatory taxes, the Garnishment Deduction must also be set up.

L. Defer Local: Click this box if the deduction is deferred from Local income tax.

M. GL Code: Enter or click on the combo box to select the GL transaction code to be assigned to this deduction.

N. Element: Enter or click on the combo box to select the Element code to be assigned to this deduction.

Note: Should you try and use an element or GL code that is inactive or nonexistent, or improper coding such as element 997000 and an expense code, the setup cannot be saved.

O. Defer Unemp: Check this box if the deduction is deferred from Unemployment Insurance eligible wages.

P. YTD Max (One time): Click this box if the deduction per pay period amount will continue to be withheld for as many years as necessary to reach the maximum amount.

B. Code: Enter a numeric code up to 9-digits. If Supplement #306, Payroll Direct Deposit has been installed, enter code number 99 with a description that says Net Direct Deposit if the total net pay is to be direct deposited.

Note: Codes 90-95 are reserved for deductions to be based on a % of hours. Code 98 is reserved for Ohio School taxes. Codes 98 and 99 are preset in the table and should not be used for anything else.

C. Description: Enter a description for the deduction.

D. A or %: Enter an “A” if the deduction is a set dollar amount. Enter a “%” if the deduction is a percentage of gross wages.

E. Defer FICA: Click this box if the deduction is deferred from Social Security tax.

F. Defer Med: Click this box if the deduction is deferred from Medicare tax.

G. Defer Fed: Click this box if the deduction is deferred from Federal Income tax.

H. Defer State: Click this box if the deduction is deferred from State Income tax.

I. YTD Max: Click this box if there will be a Year to Date maximum amount for this deduction. If this box is checked, go to the Tax/Deduction tab of the Employee File, and enter the YTD maximum amount for this deduction in the grid. Once the YTD total for the deduction reaches the YTD maximum, the deduction will cease being deducted.

J. PP Max: Click this box if there will be a Per Pay Period maximum amount for this deduction. This option can only be used with a deduction setup as a percentage. If this box is checked, go to the Tax/Deduction tab of the Employee File and enter the Pay Period maximum amount for this deduction in the grid. During payroll processing, as this percentage deduction is calculated based on the gross wages, the result will not exceed the maximum as defined.

K. Min Net: Click this box if there will be a minimum net pay amount assigned to the deduction. If this box is checked, go to the Tax/Deduction tab of the Employee File and enter the Pay Period minimum net amount for this deduction in the grid. During payroll processing, if the deduction will cause the employee’s net pay to drop below this minimum amount, the system will reduce the amount of the deduction, so the net pay equals the amount set up in the grid. If the net pay is already below the defined amount before the deduction is processed, the deduction is suspended for the current payroll. If the minimum net is to be calculated after subtracting mandatory taxes, the Garnishment Deduction must also be set up.

L. Defer Local: Click this box if the deduction is deferred from Local income tax.

M. GL Code: Enter or click on the combo box to select the GL transaction code to be assigned to this deduction.

N. Element: Enter or click on the combo box to select the Element code to be assigned to this deduction.

Note: Should you try and use an element or GL code that is inactive or nonexistent, or improper coding such as element 997000 and an expense code, the setup cannot be saved.

O. Defer Unemp: Check this box if the deduction is deferred from Unemployment Insurance eligible wages.

P. YTD Max (One time): Click this box if the deduction per pay period amount will continue to be withheld for as many years as necessary to reach the maximum amount.