WELCOME TO GMS ACCOUNTING ONLINE HELP

The help you need at your fingertips.

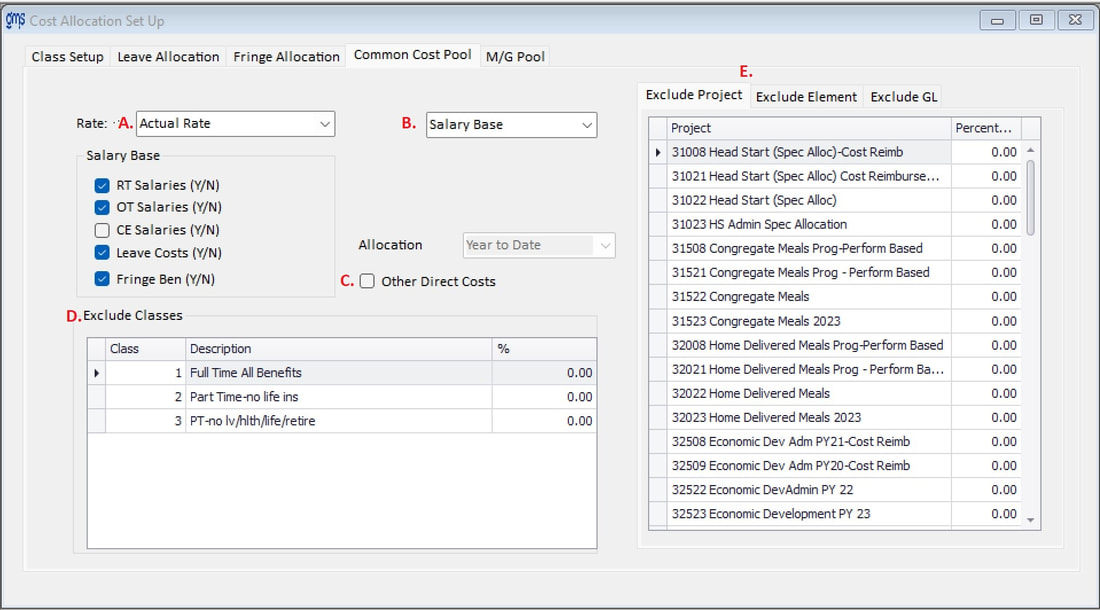

You are here: Tools > Cost Allocation Setup > Indirect Cost Allocation

Common Cost Pool

Function

This matrix will determine where and how costs from the common cost pool will be distributed during month end cost allocation procedures. This, along with the M/G Pool tab, replaces the Indirect Cost Pool tab if you have purchased the Dual Indirect Cost Pool supplement.

Things you should know

Operating Instructions

This matrix will determine where and how costs from the common cost pool will be distributed during month end cost allocation procedures. This, along with the M/G Pool tab, replaces the Indirect Cost Pool tab if you have purchased the Dual Indirect Cost Pool supplement.

Things you should know

- For subcontract/sub-grantee arrangements, if Total Direct Costs are used as a base for Indirect, only the first $25,000 of EACH sub-grantee arrangement is included in the base, so all amounts in excess of $25,000 for a sub-grant are to be excluded from the base per the new Federal Guidelines. To comply with this, in the GL Code column, enter 25000 for each line item. When the Indirect Cost Allocation is run, the prior year amount will be checked to see if the $25,000 had been met. If it had, the amount over $25,000 will be excluded. If it had not been met, the difference between the amount from the prior year and the current year will be excluded.

Operating Instructions

Select Edit to make changes to the Common Cost Pool

After making changes, select Save Edit

To print the Common Cost Pool setup select Print

A. Rate: Select the type of Common Cost Pool (actual or fixed) to be applied and select the type of indirect base (hours or salary) to be applied.

Actual Rate: Select the Actual Rate option if the Common cost pool is to be allocated using actual rates.

Fixed Rate: Select the Fixed Rate option if the Common cost pool is to be allocated using a fixed rate. Enter the Common cost percentage rate to be used for the allocation.

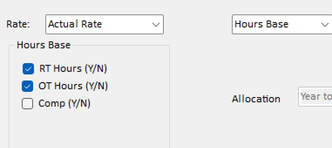

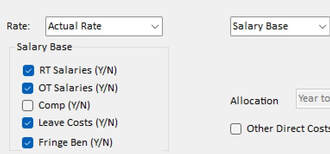

B. Base: Select the type of Base to be used. (Hours or Salary)

Hours Base: If Hours Base was selected, choose RT, OT or Comp if any/all will be included in the base.

Salary Base: If Salary Base was selected, choose RT Salaries, OT Salaries, Comp Salaries, Leave Costs, and/or Fringe Benefits if any/all will be included in the base.

C. Other Direct Costs: Select this box if the base for indirect costs is to include any other GL expense codes other than the items available for selection in the hours/salary base above. If this box is checked, all other GL expense codes will be included 100% as a part of the indirect base unless they are excluded in the grid to the right.

D. Exclude Classes: To exclude any class from the base, indicate the percentage to be excluded in the grid. These are all exclusions; leaving percentages at 0% will exclude nothing.

E. Exclude Project, Element and/or GL Codes:

To include only one or two GL codes as a part of the base, put a check mark next to Exclude All. This will automatically put 100% next to every GL code. For those GL codes you do not want to exclude from the base, change the percentage to zero. If you accidentally excluded all GL codes and saved it, click on Edit and click on the checkmark to remove the checkmark. Then save your changes

D. Exclude Classes: To exclude any class from the base, indicate the percentage to be excluded in the grid. These are all exclusions; leaving percentages at 0% will exclude nothing.

E. Exclude Project, Element and/or GL Codes:

To include only one or two GL codes as a part of the base, put a check mark next to Exclude All. This will automatically put 100% next to every GL code. For those GL codes you do not want to exclude from the base, change the percentage to zero. If you accidentally excluded all GL codes and saved it, click on Edit and click on the checkmark to remove the checkmark. Then save your changes