WELCOME TO GMS ACCOUNTING ONLINE HELP

The help you need at your fingertips.

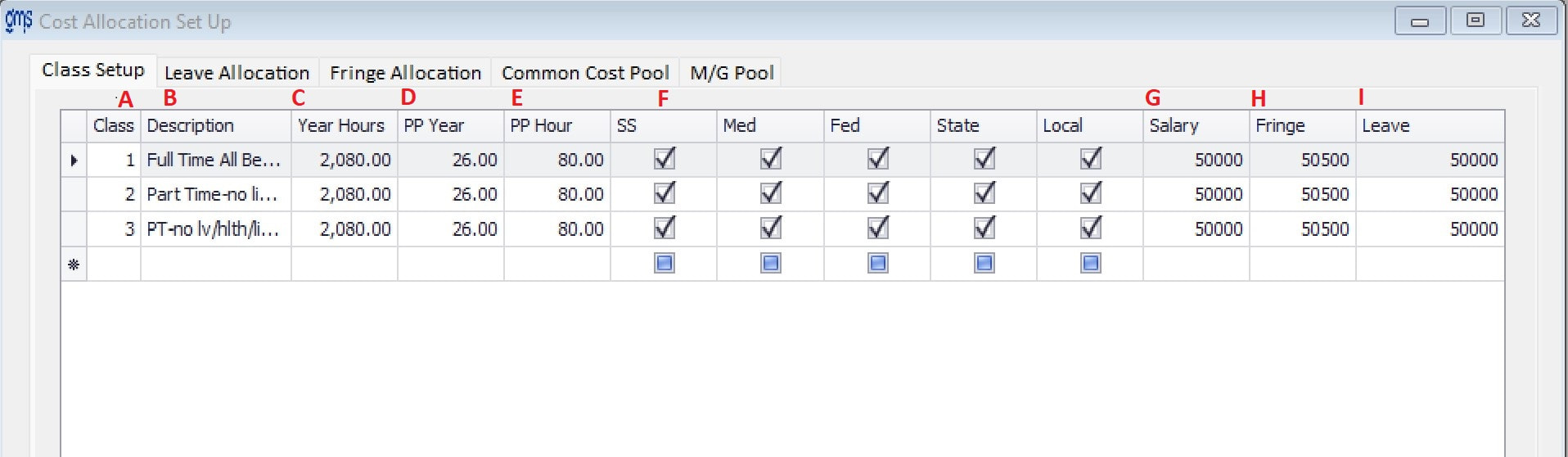

You are here: Tools > Cost Allocation Setup > Class Setup

Class Setup

Function

Holds information regarding employee classes that is used in payroll processing and month end cost allocation procedures. GMS recommends setting up classes based on the Fringe Benefits employees are eligible for. For example, Class 1 Full-time all benefits, Class 2 Full-time no retirement, etc.

Operating Instructions

Click on the Edit icon to either add a new class or edit an existing class. After completing the addition of a new class or the editing of an existing class, click on the Save Edit icon.

Holds information regarding employee classes that is used in payroll processing and month end cost allocation procedures. GMS recommends setting up classes based on the Fringe Benefits employees are eligible for. For example, Class 1 Full-time all benefits, Class 2 Full-time no retirement, etc.

Operating Instructions

Click on the Edit icon to either add a new class or edit an existing class. After completing the addition of a new class or the editing of an existing class, click on the Save Edit icon.

A Class: Enter a numeric value for the new class

B Description: Enter a description/title for the class.

C Year Hours: Enter the total number of working hours available in the year for each class of employee. For example, employees who work 40 hours per week, 52 weeks per year, the answer would be 2080.

D PP Year: Enter the total number of pay periods per year, i.e., 26 for bi-weekly, 24 for semi-monthly, etc. The system will only allow 12, 24, 26 or 52 as valid pay periods per year.

E PP Hour: Enter the total number of hours available in a pay period. If the total number of hours varies by pay period (i.e., semi-monthly, or monthly payroll), leave this at 0. When entering timesheets, a prompt asking the number of hours in the pay period will appear.

F SS: Place a checkmark in this box if Social Security taxes are to be withheld from this class of employee.

Med: Place a checkmark in this box if Medicare taxes are to be withheld from this class of employee.

Fed: Place a checkmark in this box if Federal taxes are to be withheld from this class of employee. Do not enter a checkmark if these employees are considered totally exempt. Typically, all wages paid to employees less deferrals are taxable to the Federal government, therefore this box would be checked. However, if it is not checked, it would not withhold any federal income tax and it will not report taxable wages on the W2 form.

State: Place a checkmark in this box if State taxes are to be withheld from this class of employee. Do not enter a checkmark if these employees are totally exempt. For agencies in states that do not impose state tax, such as Florida or South Dakota, not having a check in this box will cause no state taxable wages to appear on the W2’s.

Note: For employees who claim exempt on their W4 form but you are required to report taxable wages on their W2 form, check the box for that class and set it up under the employee entry, Tax/Deduction tab. Refer to that section of your Help manual for further explanation.

Local: Place a checkmark in this box if Local taxes are to be withheld from this class of employee.

G Salary: Select the general ledger transaction code where the salary for this class of employee will be posted, typically 50000. Entering a GL code other than 50000, will separate the salaries from the 50000 for that class on the R&E report.

H Fringe: Select the general ledger transaction code where the fringe for this class of employee will be posted, typically 50500.

I Leave: Select the general ledger transaction code where the leave for this class of employee will be posted, typically 50000. If leave costs are to be reported as part of the fringe line item or to report leave as a line item, select the appropriate general ledger transaction code.

B Description: Enter a description/title for the class.

C Year Hours: Enter the total number of working hours available in the year for each class of employee. For example, employees who work 40 hours per week, 52 weeks per year, the answer would be 2080.

D PP Year: Enter the total number of pay periods per year, i.e., 26 for bi-weekly, 24 for semi-monthly, etc. The system will only allow 12, 24, 26 or 52 as valid pay periods per year.

E PP Hour: Enter the total number of hours available in a pay period. If the total number of hours varies by pay period (i.e., semi-monthly, or monthly payroll), leave this at 0. When entering timesheets, a prompt asking the number of hours in the pay period will appear.

F SS: Place a checkmark in this box if Social Security taxes are to be withheld from this class of employee.

Med: Place a checkmark in this box if Medicare taxes are to be withheld from this class of employee.

Fed: Place a checkmark in this box if Federal taxes are to be withheld from this class of employee. Do not enter a checkmark if these employees are considered totally exempt. Typically, all wages paid to employees less deferrals are taxable to the Federal government, therefore this box would be checked. However, if it is not checked, it would not withhold any federal income tax and it will not report taxable wages on the W2 form.

State: Place a checkmark in this box if State taxes are to be withheld from this class of employee. Do not enter a checkmark if these employees are totally exempt. For agencies in states that do not impose state tax, such as Florida or South Dakota, not having a check in this box will cause no state taxable wages to appear on the W2’s.

Note: For employees who claim exempt on their W4 form but you are required to report taxable wages on their W2 form, check the box for that class and set it up under the employee entry, Tax/Deduction tab. Refer to that section of your Help manual for further explanation.

Local: Place a checkmark in this box if Local taxes are to be withheld from this class of employee.

G Salary: Select the general ledger transaction code where the salary for this class of employee will be posted, typically 50000. Entering a GL code other than 50000, will separate the salaries from the 50000 for that class on the R&E report.

H Fringe: Select the general ledger transaction code where the fringe for this class of employee will be posted, typically 50500.

I Leave: Select the general ledger transaction code where the leave for this class of employee will be posted, typically 50000. If leave costs are to be reported as part of the fringe line item or to report leave as a line item, select the appropriate general ledger transaction code.