WELCOME TO GMS ACCOUNTING ONLINE HELP

The help you need at your fingertips.

You are here: General Ledger > Monthly Processing > #299 Monthly Direct Workers Comp (Optional)

#299 Direct Workers Comp (Optional)

Function

Direct workers compensation calculates costs for the month and charges the costs directly to the programs that each employee worked on for the month rather than charging the costs to the fringe benefit pool. This option of charging workers comp costs is typically used only by agencies that have several workers comp rates and there is a substantial variance between the rates. If this method for charging workers comp costs is chosen, the accrued workers comp menu item under Payroll Processing will be disabled.

Under Payroll, Set Up, Workers Comp Rate, descriptions and rates are set up for each workers comp code. For all employees that are eligible for workers compensation benefits, a workers comp code needs to be entered into each employee file. The Worker’s Comp Base must also be set up under Payroll, Set Up, Workers Comp Base.

A Monthly Workers Compensation Analysis is prepared which calculates the workers comp costs for each employee and subtotals for each workers comp code. Aggregate rates are calculated for each workers comp code for the distribution of the workers comp costs by computing the ratio of workers comp costs to chargeable salaries, which are gross wages less leave taken. A Monthly Workers Compensation by Activity report is prepared showing the distribution of workers comp costs to all of the program elements excluding leave elements. A journal entry is automatically prepared for posting to the general ledger. This journal entry credits the liability account designated for accrued worker’s comp (or credits an asset account if the worker’s comp costs were prepaid) and debits the program elements based on monthly timesheet charges.

Things You Should Know

Operating Procedures

Special Rate Tab

Direct workers compensation calculates costs for the month and charges the costs directly to the programs that each employee worked on for the month rather than charging the costs to the fringe benefit pool. This option of charging workers comp costs is typically used only by agencies that have several workers comp rates and there is a substantial variance between the rates. If this method for charging workers comp costs is chosen, the accrued workers comp menu item under Payroll Processing will be disabled.

Under Payroll, Set Up, Workers Comp Rate, descriptions and rates are set up for each workers comp code. For all employees that are eligible for workers compensation benefits, a workers comp code needs to be entered into each employee file. The Worker’s Comp Base must also be set up under Payroll, Set Up, Workers Comp Base.

A Monthly Workers Compensation Analysis is prepared which calculates the workers comp costs for each employee and subtotals for each workers comp code. Aggregate rates are calculated for each workers comp code for the distribution of the workers comp costs by computing the ratio of workers comp costs to chargeable salaries, which are gross wages less leave taken. A Monthly Workers Compensation by Activity report is prepared showing the distribution of workers comp costs to all of the program elements excluding leave elements. A journal entry is automatically prepared for posting to the general ledger. This journal entry credits the liability account designated for accrued worker’s comp (or credits an asset account if the worker’s comp costs were prepaid) and debits the program elements based on monthly timesheet charges.

Things You Should Know

- If this method for charging workers comp costs is chosen, the workers comp menu item under Payroll Processing will be disabled.

- This is an optional function which is normally implemented during system installation. Should you choose to activate this option, send an email to [email protected] and request the password for the Monthly Direct Workers Comp and give your client #. If you wish to deactivate it, go to Tools, Supplement Installation/Uninstall, select #299 Mo Direct Workers Comp and click on Uninstall. This will automatically activate the Workers Comp Analysis on the Payroll Processing Menu.

- If any employees are listed under the workers comp code 0, it means that those employees did not have a workers comp code designated in their employee file. If you are required to pay workers comp on any or all of the employees listed under the code 0, go into their employee files and designate the appropriate code and redo this report.

- If an employee only has timesheet adjustments that result in zero gross pay, there is no base to calculate the workers comp rate on and the report will show no Chargeable salaries and Leave costs on the first report and no workers comp cost for the elements used in the timesheet adjustments. If you wish to adjust the worker comp amounts for the elements used in the timesheet adjustment, you will manually need to do a journal entry.

- Because the calculated workers comp rates do not come out even to two digits to the right of the decimal, there will always be a few cents difference in the two reports. This can be adjusted after your workers comp audit is completed, as you may have other adjusting entries for workers comp at that time.

Operating Procedures

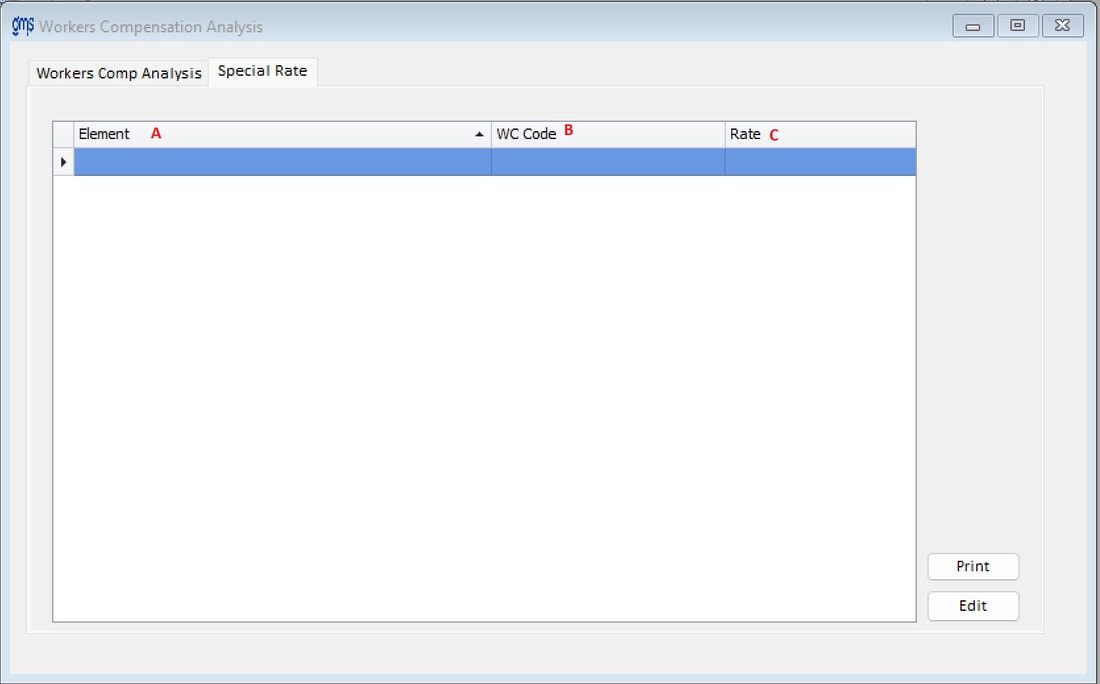

Special Rate Tab

If you have employees that are classified under more than one workers comp code because of different jobs performed, you can assign an alternative rate for certain workers comp codes under specified elements.

A. Element: Enter the element that will receive the alternative rate.

B. WC Code: Enter the workers comp code that the applicable employee has in their employee file.

C. Rate: Enter the alternative rate to be used for this element, i.e. 4.

Workers Comp Analysis Tab

A. Element: Enter the element that will receive the alternative rate.

B. WC Code: Enter the workers comp code that the applicable employee has in their employee file.

C. Rate: Enter the alternative rate to be used for this element, i.e. 4.

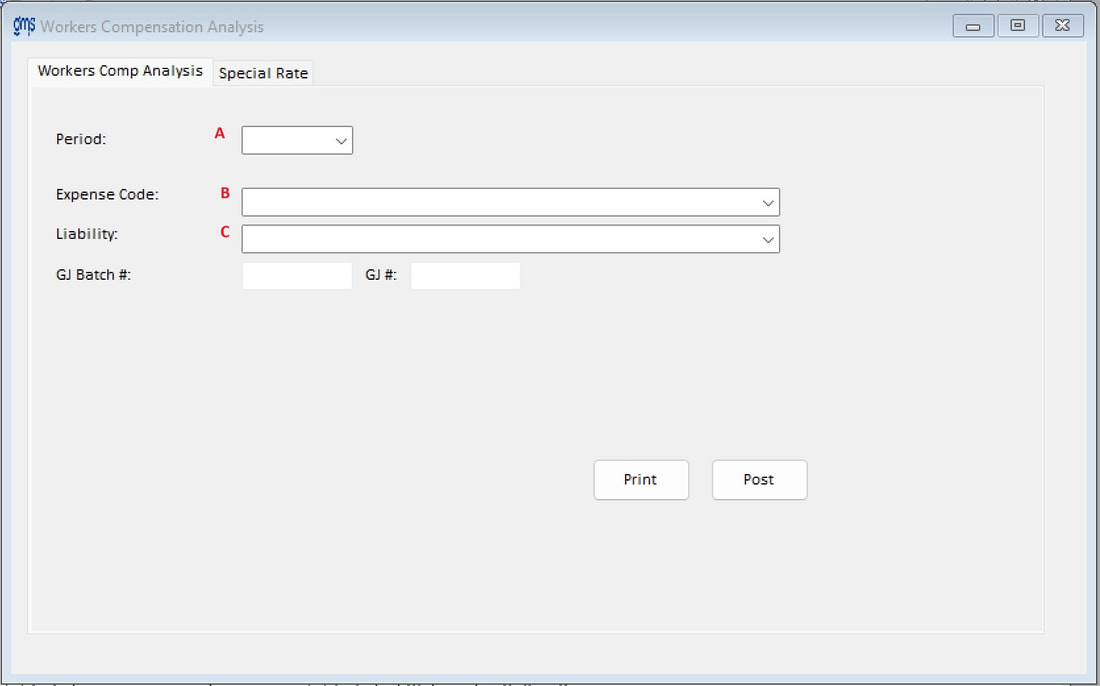

Workers Comp Analysis Tab

A. Period: Choose the month ending date.

B. Expense Code: Select the expense code for the Monthly Direct Workers Comp. An expense code that has been set up in the fringe matrix or any of the cost allocation transfer codes cannot be used. This field will default to the code entered the next time you go into this report.

C. Liability: Select the liability account you have set up for accrued workers comp. If the workers comp is a prepaid expense, select the asset account. This field will default to the code entered the next time you go into this report.

B. Expense Code: Select the expense code for the Monthly Direct Workers Comp. An expense code that has been set up in the fringe matrix or any of the cost allocation transfer codes cannot be used. This field will default to the code entered the next time you go into this report.

C. Liability: Select the liability account you have set up for accrued workers comp. If the workers comp is a prepaid expense, select the asset account. This field will default to the code entered the next time you go into this report.

The print button will print 2 reports, the Monthly Workers Compensation Analysis, and the Monthly Workers Compensation by Activity

The post button will create the Journal entry and post it to the General Ledger. The GJ Batch # & GJ # fields will be populated automatically.